child tax credit october 15

In Connecticut families can also claim 250 per child which is capped at three children - for a total of 750These payments started rolling out in late August. Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC.

Oct 15 Is Tax Deadline For Extended 2020 Tax Returns

See what makes us different.

. Millions may still be eligible for child tax credit and. Part of the American Rescue Plan eligible parents can get half of their allowance before the. An online tax filing tool now lets users claim the 2021 earned income tax credit in addition to the child tax credit and third stimulus payments.

October 15 2022 at 1138 pm EDT. Monthly payments will be 250 for older children and 300 for younger. Have been a US.

Millions of families should soon receive their fourth enhanced child. October 15 2021 at 715 am. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

The new 2021 US. Child Tax Credit Dates. As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of.

IR-2021-201 October 15. First families can expect some treats since the fourth round of advance monthly payments for the child tax credit are. Monthly payments through the new federal enhanced child tax credit will begin July 15.

In terms of monthly payments families will receive their check for 300 for each child under 6 years old. CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. For the 2021 tax year the child tax credit offers.

12 hours agoDeKalb Police searching for car involved Oct. October 15 2021 at 733 am. Parents with dependents between 18 and 24.

The IRS will send out the next round of child tax credit payments on October 15. Ontario trillium benefit OTB Includes Ontario energy and property. Check from October 15 will be sent to millions of families.

October 15 2021 142 PM CBS New York. Supplemental Security Income Benefits. Good news for parents.

By Tami Luhby CNN. Everything you need to know. Up to 3000 per qualifying dependent child 17 or younger on Dec.

The total credit is up to 3600 for each child under age 6 and up to 3000 for each child age 6 to 17. What you need to know. Wait 10 working days from the payment date to contact us.

1 day agoTaxpayers who missed the April 15 deadline have until October 17 the GAO. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially. The child tax credit scheme was expanded to 3600 from 2000 earlier this.

Taxes due to their income and who missed the April 15. Next payment coming on October 15. The advance is 50 of your child tax credit with the rest claimed on next years return.

October 5 2022 Havent received your payment. The child tax credit program which was expanded during the pandemic. The credit tops out at 3000 for children between 6 and 17 years old.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. The Child Tax Credit CTC provides financial support to families to help raise their children. Families are slated to receive 3600 for each child under the age of 6 and 3000 for each child between the ages of 6 and 17.

Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children. Child tax credit payments worth up to 300 will be deposited from October 15 Credit. Ad The new advance Child Tax Credit is based on your previously filed tax return.

October 15 Deadline Approaches for Advance Child Tax Credit. Up to 3600 per qualifying dependent child under 6 on Dec. 21 hours agoNew data proves how well it worked.

Theres also still time for people to claim the expanded Child Tax Credit which was provided last year to eligible families. The deadline to exclude yourself from child tax credit advance payments is next November 1 at 1159 pm ET. 11 homicide on I-285 I-675 exit ramp.

The credit will go to roughly 39 million. Said earlier this week. We dont make judgments or prescribe specific policies.

Census Supplemental Poverty Measure report shows that the 2021 child tax credit reduced child poverty by 46. 15 is a date to watch for a few reasons.

Cash Aid To Colorado Families Goes Out Today But Don T Count On It Next Month

Childtaxcredit Irs Issues October Child Tax Credit Some Of You Will See Less

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

October 15 Deadline Approaches For Advance Child Tax Credit Nachc Blog

4 News Now Q A What Should Parents Know About The New Child Tax Credit Kxly

Child Tax Credit Payments Could End Soon Here S What You Need To Know

Some Families Missing Out On Child Tax Credit

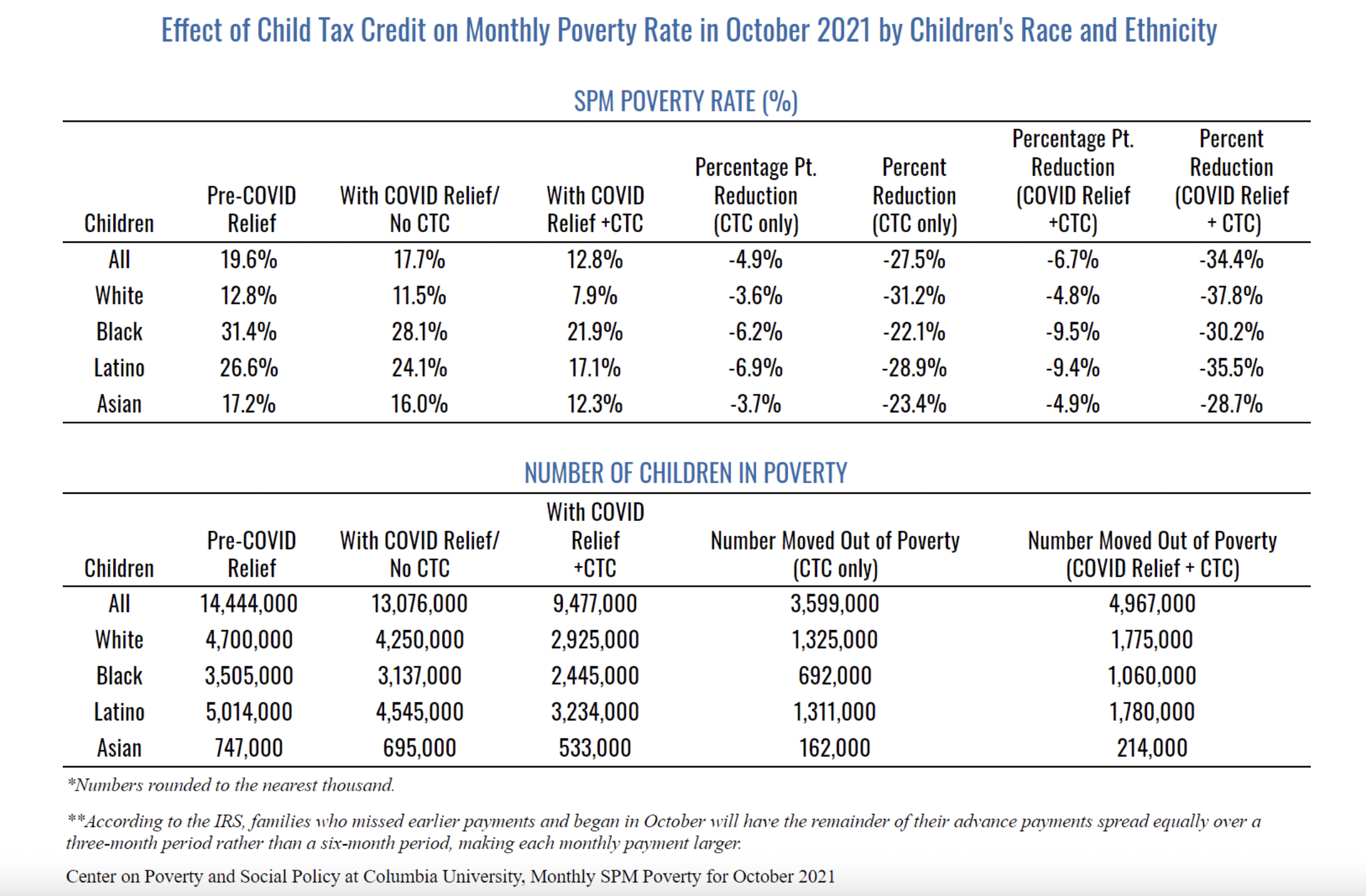

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Payments To Begin July 15 Sciarabba Walker Co Llp

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

The Impacts Of The Child Tax Credit Now And In The Future Kentucky Youth Advocates

Revised Child Tax Credit Everything You Need To Know Ramsey

When To Expect Next Child Tax Credit Payment And More October Tax Tips

Advance Child Tax Credit Update October 15 2021 Youtube

October Child Tax Credits Issued Irs Gives Update On Payment Delays

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit