how much child benefit and child tax credit will i get

You could get 2935 a year for each child. Republican Governor Phil Scott signed off on a 1000 child tax credit for every child age five and under to households earning 125000 or below.

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The Goods and Services Tax Credit.

. If you have any children after 6 April 2017 you can only get child tax credits for them if theyre your first or second child. Millions of families get child benefit though there. For each eligible child.

See what makes us different. Max refund is guaranteed and 100 accurate. You can get Child Benefit if your or your partners individual income is over 50000 but you may be taxed on the benefit.

Under 6 years of age. This is known as the High Income Child Benefit Tax Charge. The maximum benefit per child under 6 is 6997 per year 58308 per month.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The Goods and Services Tax GST Credit helps offset the financial impact of the GST for low- and modest-income people. Tax credits calculator - GOVUK.

Households with children under age 18 and net income less than 175000 will receive 250 for the first child and 200 for each additional child. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for. The State Pension has gone up too by up to 28860 a year and Universal Credit by as much as 18972 a year for couples.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Families who claimed the. If you are eligible to claim child tax credit and your annual household income comes to 17005 or less you may be due the maximum amount of child tax credit.

The maximum benefit per child for children aged 6 to 17 is 5903 per year 49191 per month. 650 would be provided per child if. The maximum amount of the credit is 2000 per qualifying child.

Making a new claim for Child Tax Credit. Read customer reviews best sellers. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six.

Free means free and IRS e-file is included. The child tax credit can be worth up to 2000 per child under 17. The CTC is a very valuable benefit for taxpayers with children.

The New Brunswick Child Tax Benefit is a monthly payment sent to low-income families to help provide for their children. The DWP has confirmed that like on other bank holidays you should instead receive benefits including Universal Credit child benefit and tax credit three days earlier on. According to the government this benefit would provide payments up to 650 per child per year depending on family income.

If youre responsible for any children or young people born before 6 April 2017 you can get up to 3480 a year in child tax credits for your first child and up to 2935 a year for each. 6997 per year 58308 per month aged 6 to 17 years. You get the maximum payment for all the children and your payment is not reduced.

The amount you can get depends on how many children youve got and whether youre. We dont make judgments or prescribe specific policies. Already claiming Child Tax Credit.

However there is a child tax credit 2022. Taxpayers who are eligible to claim this credit must list the name and Social Security number for each. Ad Browse discover thousands of unique brands.

It is comprised of the main benefit plus the working.

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The Canada Child Benefit Ccb Explained Benefit Tax Tax Prep

Romney S Child Allowance Improves On Biden Proposal People S Policy Project

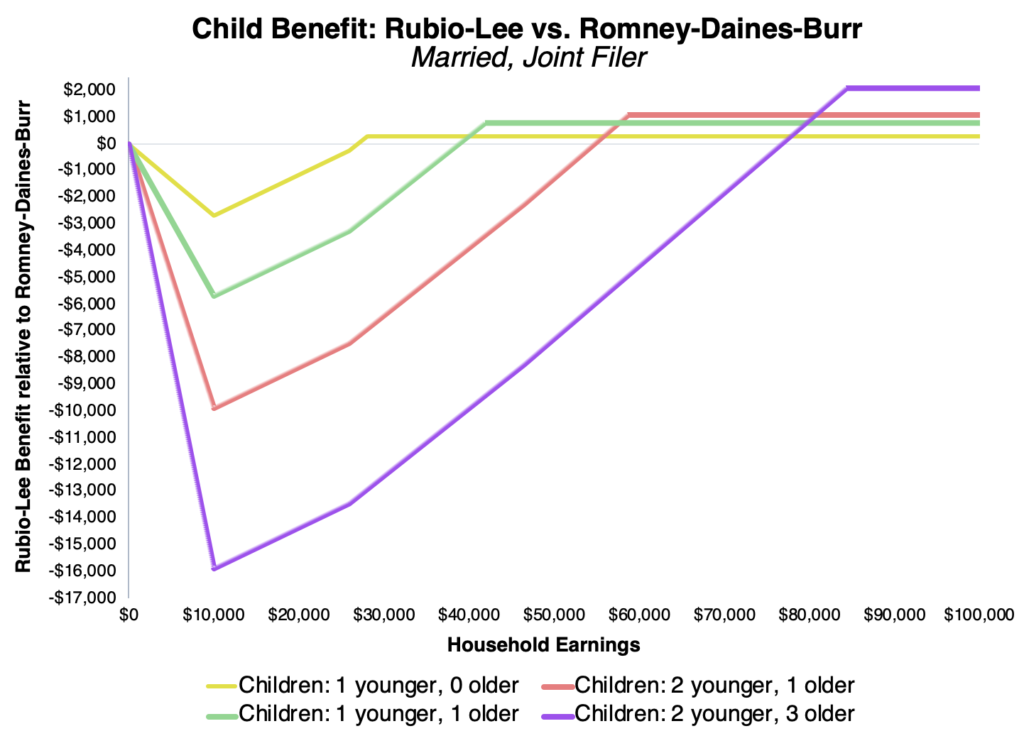

Comparing Rubio And Romney S Child Benefit Proposals Niskanen Center

Childctc The Child Tax Credit The White House

/cdn.vox-cdn.com/uploads/chorus_asset/file/6522525/Child-benefit-comparison.0.png)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox

Child Tax Credit Definition Taxedu Tax Foundation

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/22278947/Screen_Shot_2021_02_03_at_1.22.58_PM.png)

Mitt Romney S Checks Plan Up To 350 Per Month Per Kid For Parents Vox

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

What You Need To Know About The Child And Dependent Care Tax Credit Tax Credits Tax Essential Oil Samples

/cdn.vox-cdn.com/uploads/chorus_asset/file/6521033/working-family-tax-credits-1.png)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox

The Child Benefit Building Blocks Infographic Allowance For Kids Money Advice Infographic Health

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Benefits From Daycare To Swim Lessons Swim Lessons Lesson Art For Kids

/cdn.vox-cdn.com/uploads/chorus_asset/file/6520933/child_allowances_chart.jpeg)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox